A network community built on shared content relating to real estate, investing, mortgages, financing, and the financial markets www.realtyassociated.org

Monday, September 27, 2021

Fed Meeting Breakdown, Taper Cometh

Sunday, September 26, 2021

Treasuries at Risk as Fed Paves the Way for a Breakout in Yields

Wednesday, July 21, 2021

Volatility Settles Down but Monday's Selling Still Sets the Pace

|

Published Date 7/21/2021

Stock indexes early this morning were mixed, the DJIA +141 at 8:30 am ET while NASADAQ -17. The 10 yr. note began up 2 bps to 1.23%, MBS prices -2 bps from yesterday. Starting the day with less volatility, no key data today; Treasury will auction $24B of 20 yr. bonds at 1:00 pm ET.

Traders turning to earnings season as would be normal but recent volatile movement put earnings on the back shelf for the last few sessions. Johnson & Johnson, Coca-Cola Co., Verizon Communications Inc., Kinder Morgan Inc., Baker Hughes Co. and Harley-Davidson Inc. among the many, many companies reporting.

Today is the day Congress was supposed to vote on the infrastructure bill, a $1T package that will fail as bipartisan negotiations drag on. Majority Leader Chuck Schumer has set a vote for today to begin consideration of infrastructure legislation, a step that Republicans have said they would oppose absent more details on its contents and how it would be paid for. Schumer is also pushing for all 50 members of the Democratic caucus to agree to a $3.5T outline for a broad antipoverty and climate package they are pursuing in parallel to the bipartisan infrastructure talks. Democrats on the Budget Committee and Mr. Schumer had announced a deal on the budget framework last week. The $3.5T bill tied to the infrastructure bill isn't likely to get enough votes.

Mortgage applications last week declined; the composite index -4.0%, purchase apps -6.4% while re-finances were down 2.8%. It's a week old news, with this week's drop in mortgage rates we look for a dramatic increase in re-finances and purchases a week from now. Not news that purchases are slow with increasing home prices and a lack of inventories countrywide. Purchase applications the lowest since May 2020. The average contract interest rate for traditional 30-year mortgages increased to 3.11% from 3.09% the prior week; already this week 30 yr. mortgages at about 2.85%.

The Treasury debt limit is presently $28.5B, it can't exceed that level. It isn't the first time and won't be the last that that government spending will exceed the statutory limit. I has to be increased or the government will shut down, and that is not likely. Worst case, a day or two shutdown before the debt limit is increased; there have been three instances of a short shutdown over the last 10 years. On July 31, the Treasury Department technically bumps up against its statutory debt limit. Today the Congressional Budget Office is scheduled to release its latest estimate of when the government actually would be unable to pay its bills -- known as the "X Date."

At 9:30 am ET the DJIA opened +175, NASDAQ +11, S&P +9. 10 yr. note at 9:30 am ET 1.27% +6 bps. FNMA 2.0 30 yr. coupon at 9:30 am ET -16 bps from yesterday's close and -44 bps lower than at 9:30 am ET yesterday; the 2.5 coupon at 9:30 am ET -24 bps from 9:30 am ET yesterday.

The interest rate markets now still correcting from the excessive selling on Monday. The 10 yr. note technical support now at its prior resistance at 1.30%, likely to be tested. If 1.30% holds look for a new trading range for the 10 between 1.30% and 1.20%.

Source: TBWS

Tuesday, July 20, 2021

3 Charts That Show This Isn’t a Housing Bubble

With home prices continuing to deliver double-digit increases, some are concerned we're in a housing bubble like the one in 2006. However, a closer look at the market data indicates this is nothing like 2006 for three major reasons.

1. The housing market isn't driven by risky mortgage loans.

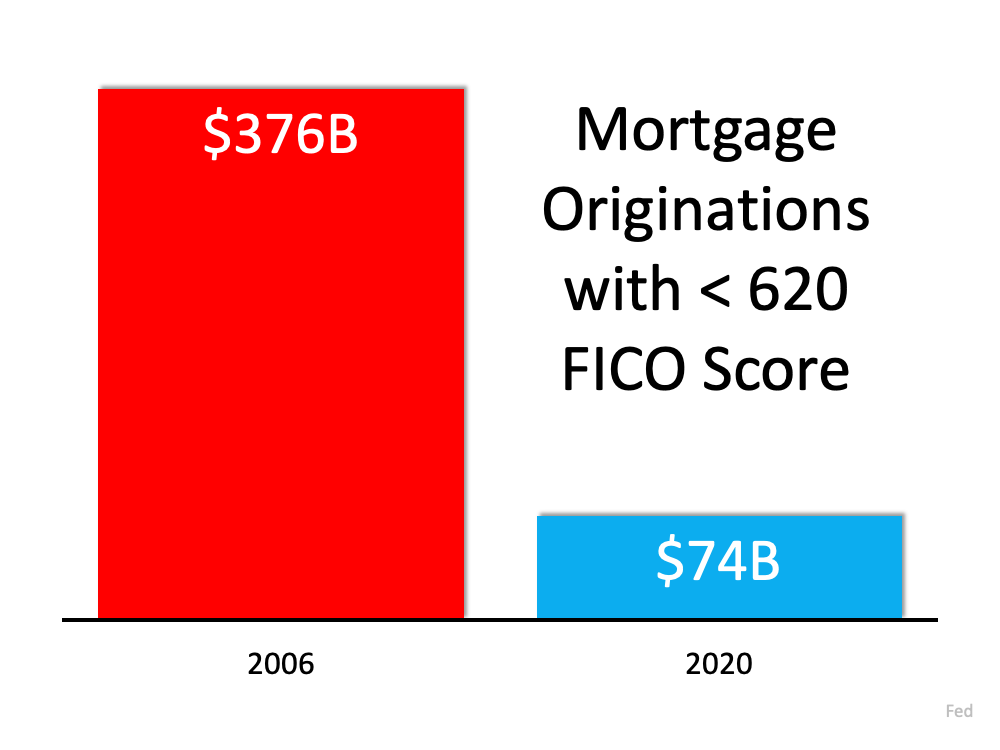

Back in 2006, nearly everyone could qualify for a loan. The Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers' Association is an indicator of the availability of mortgage money. The higher the index, the easier it is to obtain a mortgage. The MCAI more than doubled from 2004 (378) to 2006 (869). Today, the index stands at 130. As an example of the difference between today and 2006, let's look at the volume of mortgages that originated when a buyer had less than a 620 credit score. Dr. Frank Nothaft, Chief Economist for CoreLogic, reiterates this point:

Dr. Frank Nothaft, Chief Economist for CoreLogic, reiterates this point:

"There are marked differences in today's run up in prices compared to 2005, which was a bubble fueled by risky loans and lenient underwriting. Today, loans with high-risk features are absent and mortgage underwriting is prudent."

2. Homeowners aren't using their homes as ATMs this time.

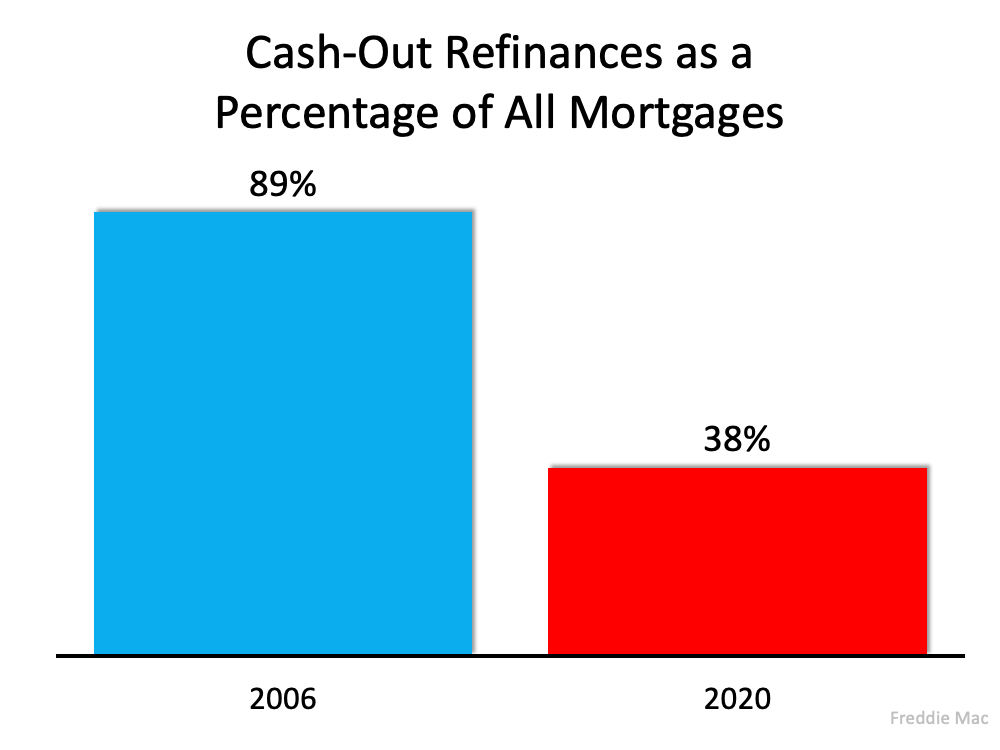

During the housing bubble, as prices skyrocketed, people were refinancing their homes and pulling out large sums of cash. As prices began to fall, that caused many to spiral into a negative equity situation (where their mortgage was higher than the value of the house).

Today, homeowners are letting their equity build. Tappable equity is the amount available for homeowners to access before hitting a maximum 80% combined loan-to-value ratio (thus still leaving them with at least 20% equity). In 2006, that number was $4.6 billion. Today, that number stands at over $8 billion.

Yet, the percentage of cash-out refinances (where the homeowner takes out at least 5% more than their original mortgage amount) is half of what it was in 2006.

3. This time, it's simply a matter of supply and demand.

FOMO (the Fear Of Missing Out) dominated the housing market leading up to the 2006 housing bubble and drove up buyer demand. Back then, housing supply more than kept up as many homeowners put their houses on the market, as evidenced by the over seven months' supply of existing housing inventory available for sale in 2006. Today, that number is barely two months.

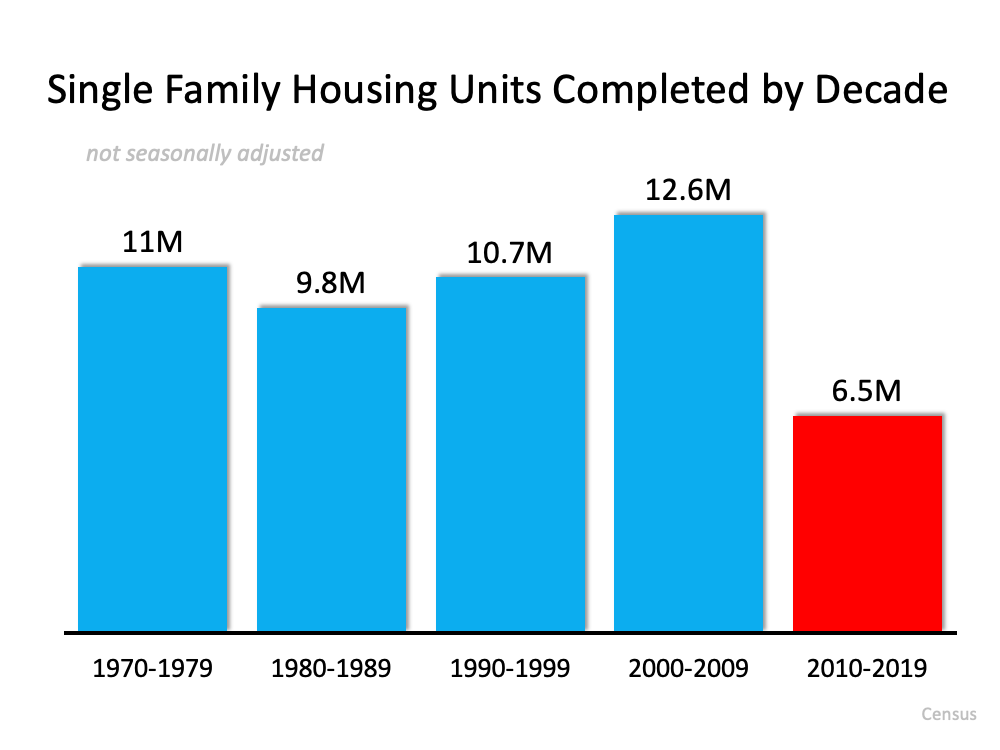

Builders also overbuilt during the bubble but pulled back significantly over the next decade. Sam Khater, VP and Chief Economist, Economic & Housing Research at Freddie Mac, explains that pullback is the major factor in the lack of available inventory today:

"The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes."

Here's a chart that quantifies Khater's remarks: Today, there are simply not enough homes to keep up with current demand.

Today, there are simply not enough homes to keep up with current demand.

Bottom Line

This market is nothing like the run-up to 2006. Bill McBride, the author of the prestigious Calculated Risk blog, predicted the last housing bubble and crash. This is what he has to say about today's housing market:

"It's not clear at all to me that things are going to slow down significantly in the near future. In 2005, I had a strong sense that the hot market would turn and that, when it turned, things would get very ugly. Today, I don't have that sense at all, because all of the fundamentals are there. Demand will be high for a while because Millennials need houses. Prices will keep rising for a while because inventory is so low."